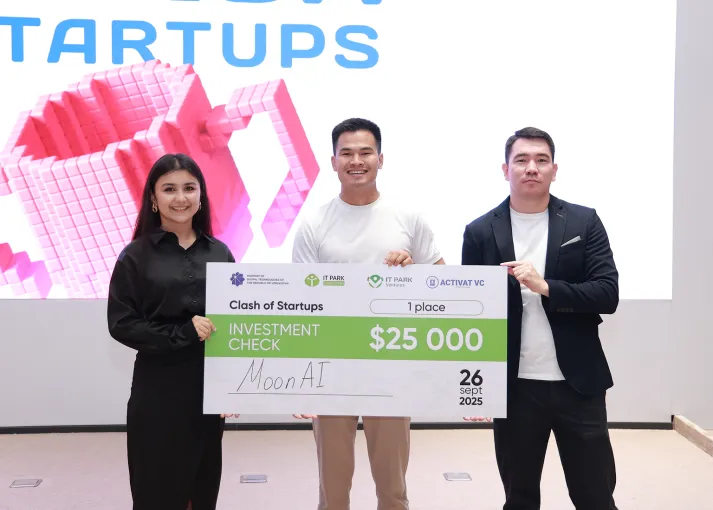

Investing in early-stage IT startups

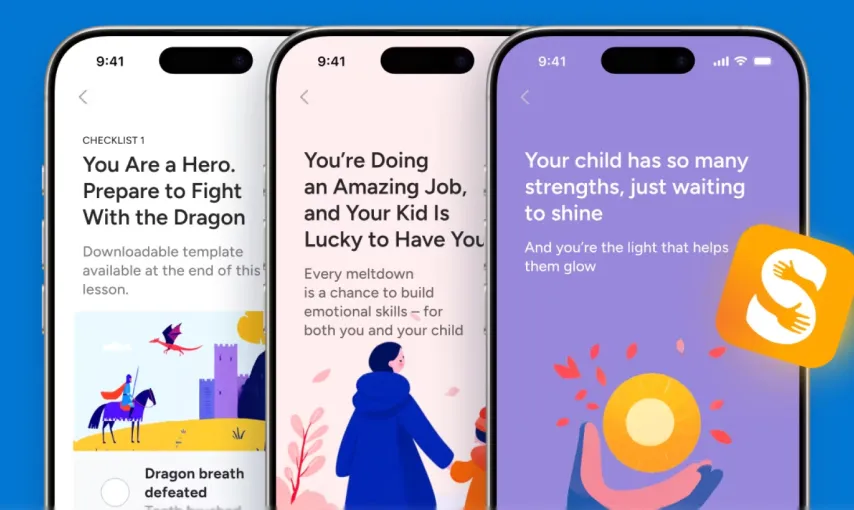

We offer not only investments, but also knowledge accumulated over 10 years in the venture world. By cooperating with us, you also get into the startup community, where you can find partners, like-minded people, and friends